Unit economics of a subscription app and how to calculate it

Updated: May 17, 2023

13 min read

Foreword

Leading apps are prioritizing unit economics to increase short-term gains and endure uncertain times. Measuring one unit of economics lets app owners focus on what matters by unlocking a real-time view of profits and costs. For subscription apps, a unit is a user. And by assessing financial returns at the user level, app owners can streamline product features, reduce transactional costs and boost investment. In this post, we’ll get into more detail and reveal how to calculate unit economics in your context.

What is unit economics?

Unit economics definition is the measurement of profits made from a single item. It’s an analytical method measuring the direct financial gains and losses – aka revenues and costs – from a specific item or unit. So what is a unit in business? For a subscription app, it’s a user. And users come in different forms. By tracking their activity and financial behavior, subscription app owners can realize precise forecasts of gross profits or losses. And they can use these forecasts to alter their tactics and achieve greater financial returns.

Most often, a unit economics calculation uses two key metrics:

- Customer Acquisition Cost (CAC) – Cost to acquire new paying users

- Lifetime Value (LTV) – Average revenue a customer will generate in their lifespan

Typical unit economics calculations for in-app subscription apps include:

- LTV/CAC = A unit economics cost ratio for investment

- LTV – CAC = A unit economics profit margin

Other metrics also help with understanding the economics of a unit. Plus, Adapty has its own bespoke in-app subscriptions calculator for boosting in-app purchases. And we’ll talk about that more later on.

Moving subscribers up the paywall to become the #1 mediation app

To offer a strong unit economics example for in-app subscriptions let’s take Calm, the #1 meditation app. In an episode of Apple’s “Business Breakdowns” podcast, brothers Jesse and Vinny Pujji review Calm’s strategy to target TOFU freemium users to convert them into paying in-app subscribers. Recognizing how user activity was at its highest during sleeping hours, Calm put more sleep-based content behind paywalls and increased in-app subscriptions.

The Pujji brothers also estimate a unit economics calculation for Calm by breaking down costs into the following:

- Each paying user delivers an average of $70 per year.

- 60% of paying users are retained in year one with 80% retained every year after, arriving at a rough gross LTV of $200.

- To calculate the potential margin, they estimate Apple App Store’s fees at $40, less $20 for producing high-quality content and another $20 for maintenance R&D.

- They conclude with an LTV at $120 and suggest a $40 CAC.

Calm’s unit economics according to the Pujji brothers

LTV/CAC = $120/$40 = 3 or a ratio of 3:1

LTV – CAC = $120/$40 = $80

Such a strong ratio suggests Calm’s model is not only highly attractive to investors but also indicates potential for longer-term profits.

The importance of monitoring unit economics

Analyzing user behavior in unit economics is one way to unlock clues to more cost-effective or revenue-generating strategies. Basing decisions on data, unit economics can leverage improvements that boost profits, performance, and investment. But there are some other specific ways it can help too.

Better profitability forecasting

Working with a unit economics model helps to review cost infrastructures that surround app users. By working outwards from a user-based starting point, app owners may find it easier to

analyze the factors that influence the revenues and costs of each user. Unit economics can also reveal the amount of capital available to invest in future growth and unlock accurate profit forecasting.

Accurate viability assessments

Engaging in a unit economics analysis helps to make a business case for a subscription app based on market viability. Questions may include: Does the app have a clear position in the market? What are the costs for user engagement? Which promotions can you run beyond ASO? ASO organic user growth maxes out between 10-20% but there are other promotions that can prove cost-effective. Unit economics offers a holistic view of user gains and losses and leverages improvements to costs and pricing plans.

Clearer determination of scalability

Working within the economics of one unit definition can reveal a sense of scalability potential. Breaking analysis into specific users makes it easier to assess an app’s value and determine the amount spent and earned from a single user. Gaining clarity on user and subscriber numbers also helps when forecasting ROI and when driving optimization and monetization potential.

Improved pricing structures

Unit economics can help with recognizing the impact of user activity on profit margins. By determining payment behaviors like in-app payments or retention costs for features like paywalls, unit economics helps to streamline decision-making on pricing. It also justifies making adjustments to pricing or features that may be adding unnecessary costs.

Enhanced sustainability

Companies can expect better long-term growth and sustainability when they provide insights into investment levels and budget allocations. From the cost of acquisition to activities that promote long-term retention, unit economics offers an effective health check on the balance sheet during uncertain economic times and major shifts in consumer behavior. And this can help investors make wiser decisions and app owners reduce unnecessary spending or waste.

Which metrics should you track in unit economics?

Knowing how to calculate units makes it easier to unlock insights into the costs and gains of app users. And since subscription apps focus on users as their unit, it’s a similar setup to calculating gains from a SaaS business. The main difference is the way that subscription apps account for all user actions. Instead, SaaS focuses on the total number of subscriptions.

So, with a focus on all activity associated with a user, you can reveal your unit economics calculation by dividing the cost of acquisition by the value of the user. This is also known as Lifetime Value (LTV) and Customer Acquisition Cost (CAC).

Below, we’ll explain more about these metrics and the others you can engage with.

Customer Acquisition Cost (CAC)

Customer Acquisition Cost (CAC) refers to the cost of attracting and acquiring a customer. Note: CAC is different from CPA in the way it focuses on paying customers, not leads. Marketers can use CPA to calculate lead generation, but not in a unit economics calculation. Since CAC represents users who actually pay, depending on your model, it may include subscribers. CAC should include marketing costs and any other outgoings that result in acquiring and closing a sale or subscriber.

CAC = Total spend on sales and marketing to acquire a paying app user in a set period / Number of app users during the same set period

Lifetime Value (LTV)

Lifetime value equates to the total profit a business earns during the lifetime of a single user. Also referred to as CLTV or CLV (Customer Lifetime Value), LTV is the net total amount received from a single user before they churn. In practice, CAC should equate to the cost of acquiring a paying user, and then LTV should reveal the value of that acquisition over the customer’s lifetime. And hopefully, it’s a long time. But unit economics is helpful for subscription apps in the way it focuses on the total activity of a subscription app user.

In a recent podcast with Adapty, Wowmaking CPO Anton Shlovenets suggests LTV is an important part of the unit economy for any non-gaming subscription product. They also state that an LTV calculation should be based on the amounts spent on attracting users. In practice, this would mean factoring ARPU over ARPPU when it comes to calculating LTV.

LTV = Average Revenue Per Paying User (ARPPU) / Churn rate

Average Revenue Per User (ARPU)

The ARPU is a measurement of the average earnings generated per unit or user. It will fluctuate based on differing variables, making it harder to benchmark an approximate value. The ARPU is a useful part of measuring LTV but it can often refer to app installs within a cohort or period of time rather than paying users.

ARPU = Revenue generated in a period / no. of users

Average Revenue Per Paying User (ARPPU)

Average Revenue Per Paying User indicates how much revenue a single user brings on average within a cohort. It’s a metric that’s designed for subscription apps since it accounts for monthly subscribers who pay for the app, over new users who may have installed but not paid anything yet. So, this will be a more useful metric to include within your calculation.

ARPPU = Revenue generated in a period / no. of paying users

Churn rate

This represents the number of paying users who lapse or cancel their subscription within a defined period of time. So this may be a year or a month. The churn rate is a percentage and should include users who fail to renew their subscriptions.

Churn rate = (Total no. of lost or lapsed users / total no. of users at the start of the period) x 100

Retention rate

The retention rate is the opposite of the churn rate. It represents the number of users retained over time. Depending on the monetization model used, this often reflects the number of app installs but can include a subsection of the number of paying subscribers. It’s often measured by month but can also be over a year.

Retention rate = (Total no. of users at the start of the period/ Total no. of lost or lapsed users) x 100

In-app purchases conversion rate (IAP)

IAP refers to the number of purchases made within an app. It’s a percentage of the no. of users who complete an in-app purchase, like an app subscription or extra content, within an otherwise free app. For a subscription app, the IAP may look something like the below:

IAP conversion rate = (Total no. of app users / no. of app users making a purchase in the app) x 100

App Store conversion rate

The app store conversion rate is a percentage measurement of the total number of users who convert in the app store. In most cases, this will be app installs. So the App Store conversion rate is the number of installs divided by the number of impressions or page views.

App Store conversion rate = (Total no. of installs / App Store impressions OR App Store product page views) x 100.

Cost Per Install (CPI)

CPI is a key marketing metric within any unit economics analysis. It’s calculated by the number of users who install apps after viewing an ad. To calculate CPI, you need to divide total marketing and advertising spend by the number of app installs. And it’s often a predetermined price that an advertiser pays a publisher for every install from their ad. Prices will vary based on platform, network, and country.

CPI = Advertising spend / No. of app installs

Cost Per Mille (CPM and eCPM)

CPM reflects the cost to gain 1k ad impressions. eCPM signals the amount of ad revenue each 1,000 ad impressions generates for this activity. So, to use this within unit economics and determine the cost of a single impression, we can divide CPM by 1,000.

CPM = (Total advertising costs / no. of impressions) x 100

eCPM = (Ad revenue earned / number of ad impressions) x 1,000

Cost Per Acquisition /Cost Per Action (CPA)

CPA represents a conversion rate for acquiring a new user or taking a specific action to do so. It’s used to calculate the number of new users or leads, but not ones who bring financial gain.

CPA = Total cost of conversions / total no. of conversions

Click to Install (CTI)

A CTI rate represents those users who click on an ad and go on to install the app. Global CTI rates average somewhere around 20%. Lower CTI rates can signal problems with poor creatives, lack of App Store Optimization, slow loading times, or an underactive or disengaged audience.

CTI = (Total no. of installs / Total no. of clicks) * 100

10 ideas

to increase

paywall conversion

Get an ebook with insights

and advice from top experts

How to calculate units

With so many metrics to consider, it may seem hard to understand how to calculate unit economics in your own context. One way to make it easier is to stay organized with performance reports, balance sheets, and profit and loss documentation. There are bound to be different scenarios where you’ll need to analyze costs, like working with publishers who may not disclose all their fees. Or reviewing the cost of traffic sources, ASO, or optimized ad campaigns. So keeping data in one place will reduce the burden when it comes to reviewing unit level economics.

Mobile publishers will recalculate a product’s unit economics every quarter. You may want to do so with a major app update or feature launch, where it’s likely your unit economics will change. Ultimately, the simplest way to calculate a unit is to find the revenue per user and divide it by the costs associated with that particular customer. Each subscription app will have a different measure of what those values are, depending on their business model. But, it’s simplified with the following equation:

Unit economics = LTV/CAC

In an ideal world, you want a healthy ratio between LTV and CAC, because if the LTV is lower than the CAC, you’ll be facing negative unit economics. Another way to present a unit economics equation may be:

Contribution margin = ARPPU – CPA/CPM/CPI

This equation is a very simplified version of unit economics but may help with gathering relevant data from the metrics above.

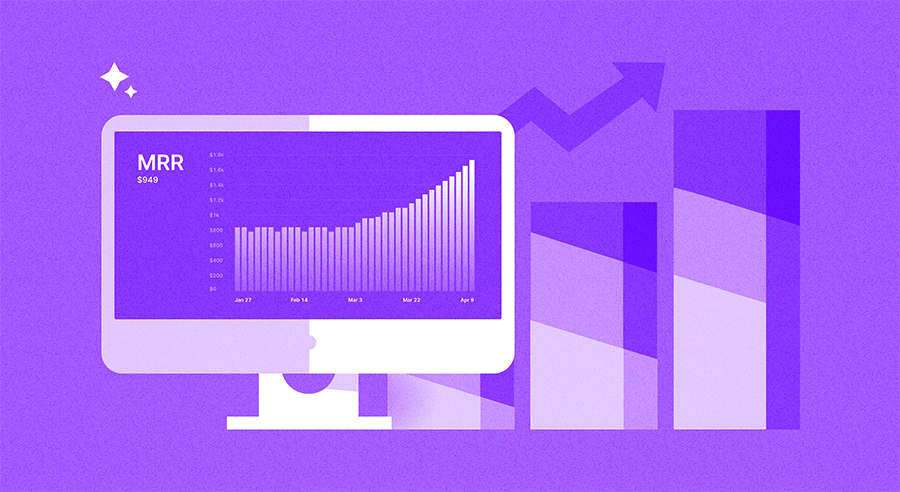

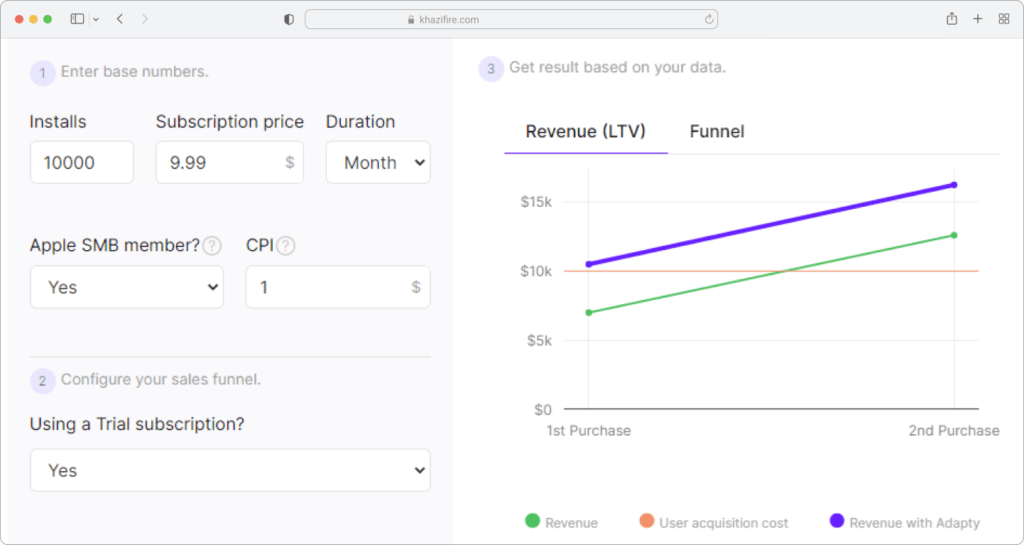

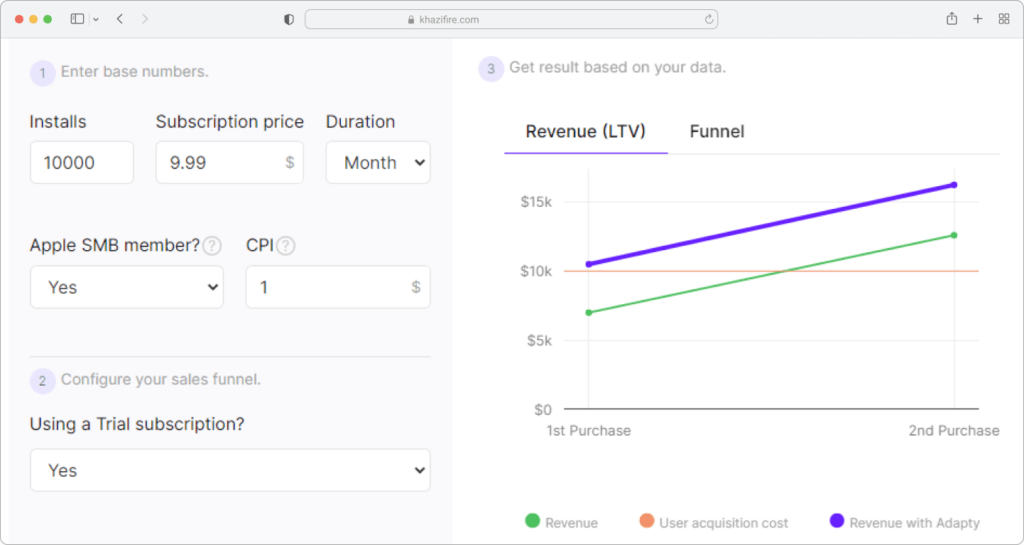

Adapty’s unit economics calculator

Adapty’s own unit economics calculator helps to gain an accurate reflection of LTV revenue generated from in-app subscriptions. With a simplified means of entering install numbers and subscription values within a specified period, our calculator makes it easier to predict LTV revenues based on CPA. So, if you run a freemium app service that converts to in-app subscriptions like our unit economics example of Calm, our calculator will give you an accurate forecast. Plus, can also compare them to the increased revenues you could achieve by partnering with Adapty.

With options to include sales funnel variables such as trial subscriptions, you can produce a unit economics calculation that reveals estimations for monthly profit and revenue gained through Adapty, which remains the best option for growing in-app purchases.

How to improve unit economics and boost profitability?

There are several alterations you can make to support app performance and boost profitability, once you know your unit economics calculation.

- Get your data in order: Get your analytics set up well. Doing so will ensure data you hold offers a true and accurate reflection of your current status.

- Benchmark your metrics: Compare your metrics with benchmarks in the same app category.

- Highlight the best traffic sources: Sometimes cheaper isn’t best. Spend time reviewing the options.

- Audit your ad campaigns: Reviewing performance across all ad campaigns may reveal the strengths and weaknesses of campaigns while highlighting potential changes.

- Engage in A/B testing: Creating new ads and using push notifications can drive success. Consider testing out new creatives or ads to target better user acquisition.

- Compare payment info with your MMP: Comparing your payment information with your Mobile Measurement Partner and your Developer Console can help with understanding genuine transactions.

- Automate reports: Keep track of regular expenses using automated systems that help with analyzing expense reports and save you time.

- Review contract terms: Analyzing terms and conditions within supplier contracts and comparing them with competitors can help understand if you’re paying too much or where you can make savings.

- Use LTV to predict growth: When LTV remains higher than CAC and your user base show growth, it’s a good indicator that your unit economics is gaining profit.

- Aim for break even: Monitoring LTV and CAC over time will help you gain an idea of whether your finances are moving in the right or wrong direction. Plus, if you’re spending too much on acquisition, unit economics should help to highlight that.

Conclusion

It’s vital for subscription apps to understand unit economics and find an accurate way to calculate lifetime returns on a single user. Staying profitable through challenging times is possible with the razor-sharp application of unit economics at regular intervals. By offering opportunities to review user activity and calculate costs and revenues brought in, getting good at unit economics is a skill that will serve you well. Adapty has a range of tools that support better unit economics, enhanced optimization, and lower costs. This can all add up to increased profitability, improved sustainability, and, with Adapty’s help, more opportunities to grow in-app purchases.

FAQs

Gaining an accurate understanding of the cost of bringing in new users, along with how much profit they’ll make for you during their lifetime, is key to effective budgeting. Unit economics helps subscription apps to do this by revealing primary gains and losses from attracting and retaining users. Plus, it helps to determine other important business measures like profitability, sustainability, and long-term growth.

By spending less on sales and marketing through budget cuts, you can redress the LTV: CAC ratio and gain a more balanced approach. A good ratio should be around 3:1. Any unit economics model should give you the freedom to take positive action by reducing sales and marketing expenditures.

A better option to gain a higher ratio for LTV is to invest more time and resources in improving your LTV. This will more often come down to offering the right pricing, along with proactive measures to reduce churn. These steps can lead to customers spending more time with you.

CLV and CLTV are two acronyms that both stand for Customer Lifetime Value. They represent the same thing as Lifetime Value (LTV) expressed in a different way. All three acronyms refer to the same thing, i.e. the total amount of net revenue an app user brings to a subscription app before they come to the point of churn and stop generating revenue.

Further reading